Melinda Gates on VC industry & investing with Aspect Ventures

Melinda Gates: The VC industry 'needs to clean up its act'

Melinda Gates first heard about the controversial memo written by an engineer at Google from her husband, Bill -- the billionaire founder of Microsoft.

"He basically said, 'You're not going to believe this,'" Gates told Poppy Harlow at CNNMoney's American Opportunity breakfast in New York on Tuesday.

(Read post on CNN Money)

In August, Google found itself at the epicenter of the debate over sexism in Silicon Valley when engineer James Damore claimed in a viral 3,300-word essay that women aren't as well represented in the tech industry because they are biologically different than men.

That perspective didn't sit well with Gates.

"When I read that Google memo, I didn't know whether to be sad or whether to be outraged. And I think the sadness came first. The sadness to see that kind of point of view," she said in her first public remarks on the issue.

Gates, who studied computer science and worked as a developer at Microsoft (MSFT, Tech30) until 1996, said she decided not to speak out at the time because she thought "enough people were."

She pointed to an op-ed by YouTube CEO Susan Wojcicki as an exemplary response.

In her column, Wojcicki relays a conversation with her daughter about the memo. She goes on to talk about how she continues to experience sexism within the tech industry, and how she empathizes with the women at Google who now face "a very public discussion about their abilities."

"To me, that was the most poignant piece and nothing else needed to be said for me," said Gates, who is co-chair of the Bill & Melinda Gates Foundation.

Gates said the industry's gender problem is clear just by looking at the numbers.

When she was in college, 37% of computer science graduates were female. Now it's 18%, she said.

Things got worse when games started to become more "genderized," with a focus on sports and killing, she said.

"[A]ll the sudden, when games started to become very genderized, you started to see the downtick. This huge falling off of women wanted to go into computer science," she said.

Making matters worse are hidden biases throughout the male-dominated tech industry, she said. The venture capital community, in particular, "needs to clean up its act."

"I think they also fund what they know," Gates said. "Today, they know male, white, Caucasian, in a hoodie, looks like a geek, comes from an Ivy League or equivalent school. That's their funding criteria."

Only 6% of VC partners today are women, Gates added, and a mere 3% of companies led by women get VC funding.

Gates is tackling the problem with her own money. Over the next 18 months, she plans to finance groups with funding models that show a commitment to gender equity. She's already partnered with Aspect Ventures, a San Francisco-based VC firm founded by two women.

"Moving money is what will move the industry for women," she said.

Gender discrimination is something Gates says she personally experienced "all the way through" her studies and career.

Sexism was less of an issue inside Microsoft, Gates said, but it would occur when she'd attend industry events like conferences.

Even in her philanthropic work, it's a recurring issue.

"I still walk in places with Bill, and people... they assume he's the smartest person in the room, almost no matter if it's a man or a woman who walks in," Gates said. "But as soon as I open my mouth, you can sometimes look at the person's face and they're kind of like, 'Wow, she knows something, too.'"

Gates says such hidden biases influence both men and women and are made worse by the fact that they're so rarely addressed.

"We don't talk about what's going on," she said. But now she believes things are finally starting to change.

"Tech is invasive," Gates said. "It's in all of our lives. Don't you want the people who are sitting behind that, programming it, to be people who have diverse points of view?"

New Aspect Ventures COO talks VC operations, diversity

Aspect Ventures, a female-founded VC firm, has appointed Kendra Ragatz as COO and general partner. Ragatz is stepping into a two-fold role: In addition to making investments, she's in charge of growth and development for the firm itself.

(Read post on PitchBook)

Theresia Guow and Jennifer Fonstad founded Aspect in 2014 and closed its debut vehicle on $150 million the next year. The firm, which is currently raising a second fund with a $175 million target, is focused on early-stage investments in several industries, including security, digital health, AI and autonomous vehicle software. It writes seed and Series A checks.

As of now, Aspect has backed more than 30 startups, including travel booking platform HotelTonight and Chime, the provider of a savings app.

A unique role: venture capital COO

The COO position is relatively unique among investment firms. Because of the nature of the business, private equity and venture capital investors tend to devote their time, energy and finances to helping other companies grow.

"Today, more and more VC firms are focusing on running their own businesses to the same degree they focus on helping their portfolio companies," said Ragatz (pictured) in an interview with PitchBook.

In her new role, Ragatz will do just that: She'll help develop Aspect Ventures by focusing on recruiting, finance and operations, in addition to mentoring the firm's investors. Before joining the Bay Area-based VC firm as an operating partner at the end of 2016, Ragatz held more traditional roles at investment firms including DAG Ventures and Steamboat Ventures, Disney's venture capital arm.

In addition to her COO duties, Ragatz will have a more traditional partner role. She'll seek out new investment opportunities for Aspect, some of which will likely be in the health and wellness sector.

Women in VC: 'Diversity generates better outcomes'

A VC firm founded and run by two women is something of a rarity in Silicon Valley. Ragatz said the firm's co-founders, Guow and Fonstad, are some of the only female investment professionals she's ever worked with. While the firm doesn't necessarily make a point of investing in female-founded startups, its portfolio does include a fair number of them.

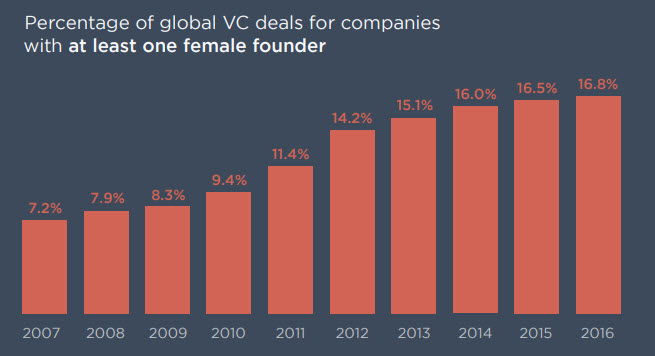

The percentage of global VC deals for companies with at least one female founder sits at about 17%, per PitchBook data. Here's a closer look at VC investment in female-founded companies over the last decade, as of March 2017:

*The chart above is from a datagraphic PitchBook produced in March.

Ragatz said Aspect's portfolio tends to be more diverse than average.

"It's not our strategy to invest solely in female founders, but I do think Aspect being founded by two female general partners and having further diversity amongst our investing team creates a strategic advantage for our firm in attracting top-notch entrepreneurs," she told PitchBook. "At the end of the day, and there is a lot of data to support this, we do believe that diversity generates better outcomes."

Aspect backs TheRealReal, the online consignment company founded by Julie Wainwright that reached a $450 million valuation in June. Other notable female-founded startups in the firm's portfolio include subscription beauty company Birchbox and career guidance platform The Muse.

Firms like Aspect are at the forefront of building diversity in the tech community. "I'm hopeful that as the industry attracts and promotes more female VCs, and there are more female entrepreneurs starting businesses, it will create a cycle of opportunity for even more women to enter into tech and succeed."

A Pledge for Decency and Broader Opportunity for All

The technology ecosystem continues to be challenged for many women as a respectful, safe place to work and thrive.

(Read post on Medium)

Just last week alone the industry saw the resignation of Uber CEO Travis Kalanick on the heels of Eric Holder’s investigation into Uber’s culture and workplace practices. The week ended with sexual harassment allegations against venture capitalist Justin Caldbeck which has continued to spiral deeper into the industry this week around the permissive role others played in allowing the behavior over many years. The brave stand to go on the record by three female founders is forcing the venture capital & start up community to take a hard look at why unwanted sexual advances toward women in the workplace continue to be an issue.

We believe the issue is broader than just curbing sexual harassment. Data has shown repeatedly that diversity in a company’s leadership boosts the bottom line. It has the natural benefit that when you have broad diversity around the table, people are more thoughtful in how they treat each other and power dynamics change throughout the organization. What you say matters. What you permit matters. And what you do matters. Now more than ever.

The data continues to underscore this message. This week, The Harvard Business Review released data based on 140 VCs and 189 entrepreneurs that found male-led companies raised five times more funding than the female-led startups. The study found that female entrepreneurs are asked different questions and judged on a different set of standards compared to their male counterparts. It’s not the first time we’ve seen this issue. In 2016, women received just 2% of VC funding overall.

And, during a peer-reviewed study earlier this year in Sweden, researchers observed that venture capitalists described female and male entrepreneurs with drastically different words, from calling the male entrepreneurs “Young and Promising” while calling similar female entrepreneurs, “Young and Inexperienced.” Whether it’s unconscious bias or not, it must end if we want parity for women in venture capital, or women seeking funding as entrepreneurs.

It’s not about one bad apple but about a culture that permits or passively allows these power dynamics to remain. When tech, venture, and private equity firms share power broadly, such behavior would be unthinkable. When less than 1% of all venture investors share equal power and economics in a firm, it takes a lot of effort for it not to happen.

Thanks to LinkedIn founder and Greylock partner Reid Hoffman, VCs and founders across the tech industry are now signing up to #DecencyPledge, making it clear that we will not tolerate sexual harassment. Kudos to Reid as a successful entrepreneur and well respected male VC for kicking this off. If we are going to reshape the tech start up culture to be more inclusive for all, it will take men AND women working together.

It’s a great start, but our hope is that it is just that: a start. We hope it will spark a broader conversation, not just on zero-tolerence for harassment of women, but also on addressing gender (and other types) of discrimination in the tech ecosystem. We are urging leaders in the technology ecosystem to consciously work to bring a diverse leadership team directly into their companies and portfolios. Only through a conscious, purposeful effort will organizations change. Join us in actively driving this change in all that you touch and do throughout our ecosystem. Let not technology lag the world but demonstrate how diverse, open cultures lead to better workplaces and better outcomes for the business.

We are asking our community and fellow VCs to make the #BoostOpportunityPledge. Meaning, we won’t tolerate sexual harassment or gender discrimination and will work tirelessly to build a more fair and safe workplace. Women need to actively bring along diversity as well. It’s not just a men problem, it’s a people problem. Let’s get to work.

Wake-up Call in Silicon Valley

Theresia Gouw provides insight to top tech trends, including the departure of Uber CEO Travis Kalanick, "super voting rights," and change in corporate culture in the Valley. Also Gouw provides her play on Amazon and Wal-Mart.

(Watch interview on CNBC)

How to Increase Diversity in Silicon Valley

Aspect's Theresia Gouw talks with Techonomics about investing in tech, taking risks and what she sees as the good news about diversity in Silicon Valley.

(Listen to two segments of interview on Techonomics)

Stem raises $8M to get music artists paid more seamlessly

While music streaming has become more and more commoditized, artists still have a wide array of places to distribute their songs like Spotify, YouTube and Apple Music — but getting paid properly can start to complicate things.

(Read on TechCrunch)

That problem gets even more difficult when there are multiple people collaborating on the same song and it’s not clear who is getting how much of a cut from the revenue share from those services. That, on top of that the general unpredictability of an artist’s revenue, has left a hole that Stem co-founder Milana Rabkin thinks her and her co-founders startup Stem can fill. To do that, the company has raised $8 million in financing led by Evolution Media and Aspect Ventures, along with several other strategic investors and continuing participation from Upfront Ventures.

Stem works to collect the revenue from those tracks in disparate platforms and sources it into a sort of escrow. It then pays out the artists based on a previously agreed level of involvement and revenue share. Rabkin said that each artist and collaborator has to sign off on the share. When a track is uploaded, the artist defines those share percentages, and then the revenue is distributed out more quickly than traditionally if it went through the typical channels. Rabkin said users should start getting data within the first 30 to 60 days of publishing.

“A lot of the new tools that have been created in the fintech space have really been focused on the services that have enabled independent small businesses to grow on their own,” Rabkin said. “Artists and creators are no different, the problem is no one’s created tools that cater to them. If you look at Intuit you have Mint, but for an artist with unpredictable income and difficult to track revenue streams [it’s different]. You can plug in your bank account, but Intuit and mint doesn’t plug into iTunes or YouTube or Spotify.”

Another problem Stem is trying to tackle is ensuring that collaborators that may not be able to monetize their content. Some artists — like first-timers — may be releasing content but have to treat it purely as promotional or marketing. Instead of just focusing on making money of touring, Rabkin said Stem will hopefully offer those artists some way of driving revenue right from the get-go.

The data that Stem brings in from all these disparate platforms may also, itself, be valuable. Artists can get information on their listeners and start to zero in on some of their preferences. That might help them tailor their tours or other parts of their marketing. But adding information around revenue streams on top of that adds another layer of data that can signal a much stronger level of engagement than some of the other signals they might have.

“The problem that exists is in the supply chain in the music business, that hasn’t been [solved],” Rabkin said. “There’s new exciting frameworks that have been developed, really great tools to normalize data in relational databases. Those types of tools, they make it really easy to start tackling these problems in a way that wasn’t possible years ago.”

Rabkin said she doesn’t view Stem as competitive with distribution services, as the company is trying to get everything funneled into one place just to sort out who gets paid what. Right now the company has to take over the process, but part of the reason Stem is raising money is to build the tools it has in a way that other distributors can use.

There will likely be plenty of competition in the space. Kobalt, for example, raised $75 million at a $775 million valuation last month. And each of these services — like iTunes or Spotify — may end up simplifying their artist tools down enough that it may not require such complicated background gymnastics to figure out how to get the right people paid. But Rabkin hopes that by building a seamless enough experience Stem will be able to attract a wide artist base that includes Frank Ocean, Childish Gambino, DJ Jazzy Jeff, Anna Wise, Chromatics, and Poolside.

What James Comey’s Firing Means For the Future of Cyber Attacks

Theresia Gouw and Jennifer Fonstad on the future of cyber-attacks.

Following Presidents Trump’s abrupt termination of FBI Director James Comey earlier this month, the US government is left in a vulnerable spot as officials struggle to create the right policies to avoid cyber-attacks. Comey was one of the few federal officials equipped to get the job done right; he handled the investigation into Hillary Clinton’s use of a private email server and led a criminal investigation into whether Trump advisers colluded with the Russian government to steer the 2016 presidential election.

(Read on Fortune)

Although the Justice Department last week appointed ex-FBI director Robert S. Mueller III to head the investigation in Comey’s place, the developments nonetheless beg broader questions over what kinds of protections against cyber-attacks should Americans expect from the US government?

Without senior leadership in many of these government agencies, very few agencies are willing or even able to make large financial outlays or make decisions for new software, architecture, or counter-measures. Per reporting from Politico and USA Today, top-ranking positions across U.S. Defense, Treasury, and State departments, as well as key ambassador spots, are still awaiting appointments. In other words, rather than addressing the issue with press-laden, sweeping executive orders, perhaps the problem is simpler – putting talent into key open positions and enabling them to do their jobs. While Trump’s full cabinet has been confirmed, the Nonpartisan Partnership for Public Service has identified 557 ‘key’ government appointments that have yet to be confirmed by the Senate (not to mention the thousands of appointments that do not require Senate confirmation).

As time passes and without leadership in place, any decisions around major cybersecurity initiatives must be put on hold.

Former President Obama proposed a $19 billion cybersecurity plan in 2015 and 2016 (as part of the President’s Fiscal Year 2017 Budget) to improve IT infrastructure. But many deals are on hold while awaiting President Trump’s team that would help replace old government systems that are the most vulnerable to cyberattacks. While Trump did sign a separate cybersecurity order earlier this month, it’s improvements are incremental. Even as Trump also proposed increases in cybersecurity budgets for U.S. Homeland Security, he still flirts with the notion that a government shutdown would be “good for government,” as suggested ina recent tweet. As government employees worry about getting paid and are furloughed, America’s capacity to build and secure its digital boundaries flounders.

It is now time to start building a more comprehensive plan for protecting and prosecuting cyber-attacks against our citizens and organizations. As Fortune 500 companies make cybersecurity a responsibility that even corporate board members are held to, perhaps it’s time for the Administration to appoint a cybersecurity czar to direct and manage cybersecurity across agencies, reporting directly to the President. Similar to coordinating physical security, cybersecurity needs to be elevated in mindshare, management, and resources. A proactive approach must be the priority. Rather than acting in a reactionary way, this approach enables leadership to coordinate efforts across agencies and internationally, and may provide impetus for filling positions more rapidly and effectively across the organization in the same way the private sector protects itself from cyber hacks.

Unfortunately, it’s not enough to keep the police on the streets and the military bills paid anymore. When governments are compromised by a hack, their people and their organizations are held up for ransom and the leadership is bogged down in identifying where the blame lies. How can we expect to protect ourselves? Let’s not wait until there is another Federal breach that undermines the security of our nation (remember the Office of Personnel Management hack in 2015?) to put a spotlight on the problem. What we’ve seen so far is just the beginning.

The 50 Most Powerful Moms of 2017

Jennifer Fonstad joins Melinda Gates, Adele, Sheryl Sandberg and other fantastic women on Working Mother's list of The 50 Most Powerful Moms of 2017.

(Read on Working Mother)

Jennifer Fonstad, Partner, Aspect Ventures/Entrepreneur

Children: 18, 16, and 12-year old twins.

Venture capital was largely considered a man’s world—until this working mom came along! Along with partner, MPWM Theresia Gouw Ranzetta, her company, Aspect Ventures, is one of the few women-led venture capital firms in Silicon Valley. Last year, she was named “Venture Capitalist of the Year” at the Deloitte Technology 2016 Fast 500, marking the first time a woman won the award. Jennifer had the vision to invest in now popular brands, such as BirchBox, UrbanSitter and TheRealReal. Prior to Aspect, Jennifer was Managing Director with Draper Fisher Jurvetson, helping to take them from $150 million under management to more than $3.5 billion, before she left to form Aspect. She’s made the Forbes Midas List twice, and, according to the Silicon Valley Business Journal, has also “taught in Kenya, trekked after wild gorillas in Africa and now serves as chairperson of the Somaly Mam Foundation, which focuses on ending sex slavery of underage girls around the world.” Her myriad of accomplishments are major #workmomgoals, for sure.

Is the Gig Economy Working?

Aspect's Jennifer Fonstad and The Muse's Kathryn Minshew provide perspective on the "future of work" in this piece in The New Yorker on the Gig Economy.

(Read on The New Yorker)

Not long ago, I moved apartments, and beneath the weight of work and lethargy a number of small, nagging tasks remained undone. Some art work had to be hung from wall moldings, using wire. In the bedroom, a round mirror needed mounting beside the door. Just about anything that called for careful measuring or stud-hammering I had failed to get around to—which was why my office walls were bare, no pots yet dangled from the dangly-pot thing in the kitchen, and my bedside shelf was still a doorstop. There are surely reasons that some of us resist being wholly settled, but when the ballast of incompletion grew too much for me I logged on to TaskRabbit to finish what I had failed to start.

On its Web site, I described the tasks I needed done, and clicked ahead. A list of fourteen TaskRabbits appeared, each with a description of skills and a photograph. Many of them wore ties. I examined one called Seth F., who had done almost a thousand tasks. He wore no tie, but he had a ninety-nine-per-cent approval rating. “I’m a smart guy with tools. What more can you want?” he’d written in his profile. He was listed as an Elite Tasker, and charged fifty-five dollars an hour. I booked him for a Wednesday afternoon.

TaskRabbit, which was founded in 2008, is one of several companies that, in the past few years, have collectively helped create a novel form of business. The model goes by many names—the sharing economy; the gig economy; the on-demand, peer, or platform economy—but the companies share certain premises. They typically have ratings-based marketplaces and in-app payment systems. They give workers the chance to earn money on their own schedules, rather than through professional accession. And they find toeholds in sclerotic industries. Beyond TaskRabbit, service platforms include Thumbtack, for professional projects; Postmates, for delivery; Handy, for housework; Dogvacay, for pets; and countless others. Home-sharing services, such as Airbnb and its upmarket cousin onefinestay, supplant hotels and agencies. Ride-hailing apps—Uber, Lyft, Juno—replace taxis. Some on-demand workers are part-timers seeking survival work, akin to the comedian who waits tables on the side. For growing numbers, though, gigging is not only a living but a life. Many observers see it as something more: the future of American work.

Seth F.—the “F” stood for Flicker— showed up at my apartment that Wednesday bearing a big backpack full of tools. He was in his mid-forties, with a broad mouth, brown hair, and ears that stuck out like a terrier’s beneath a charcoal stocking cap. I poured him coffee and showed him around.

“I have molding hooks and wire,” I said, gesturing with unfelt confidence at some coils of translucent cord. “I was thinking they could maybe hang . . .” It struck me that I lacked a vocabulary to address even the basics of the job; I swirled my hands around the middle of the wall, as if blindfolded and turned loose in a strange room.

Seth F. seemed to gather that he was dealing with a fool. He offered a decision tree pruned to its stump. “Do you want them at eye level?” he asked.

“Eye level sounds great,” I said.

Seth F. had worked for TaskRabbit for three years, he told me as he climbed onto my kitchen stool—“like twenty-one years in normal job time.” In college, he had sold a screenplay to Columbia Pictures, and the film, though never made, launched his career. He wrote movies for nine years, and was well paid and sought after, but none of his credited work made it to the big screen, so he took a job as a senior editor at Genre, a now defunct gay magazine, where he covered the entertainment industry. He liked magazine work, but was not a true believer. “I’m one of those people, I think, who has to change jobs frequently,” he told me. He got a master’s degree in education, and taught fourth grade at Spence and at Brooklyn Friends. Fourteen years in, a health condition flared up, leaving his calendar checkered with days when it was hard to work. He’d aways found peculiar joy in putting together IKEA furniture, so he hired himself out as an assembly wiz: easy labor that paid the bills while he got better. He landed on TaskRabbit.

“There are so many clients, I rarely get bored,” he told me. He was feeding cord through the molding hooks to level my pictures. At first, he said, hourly rates at TaskRabbit were set through bidding, but taskers now set their own rates, with the company claiming thirty per cent. A constellation of data points—how quickly he answers messages, how many jobs he declines—affect his ranking when users search the site. He took as many jobs as he could, generating about eighty paid hours each month. “The hardest part is not knowing what your next paycheck is from,” he told me.

Seth F. worked quickly. Within an hour, he had hung six frames from the molding over my couches. Sometimes, he confessed, his jobs seem silly: he was once booked to screw in a light bulb. Other work is harder, and strange. Seth F. has been hired to assemble five jigsaw puzzles for a movie set, to write articles for a newspaper in Alaska, and to compose a best-man speech to be delivered by the brother of the groom, whom he had never met. (“The whole thing was about, ‘In the future, we’re going to get to know each other better,’ ” he explained.) Casper, the mattress company, booked him to put sheets on beds; Oscar, the health-insurance startup, had him decorate its offices for Christmas.

As we talked, his tone warmed. I realized that he probably visited strangers several times a day, meting out bits of himself, then moving on, often forever, and I considered what an odd path through professional experience that must be. He told me that he approached the work with gratitude but little hope.

“These are jobs that don’t lead to anything,” he said, without looking up from his work. “It doesn’t feel”—he weighed the word—“sustainable to me.”

The American workplace is both a seat of national identity and a site of chronic upheaval and shame. The industry that drove America’s rise in the nineteenth century was often inhumane. The twentieth-century corrective—a corporate workplace of rules, hierarchies, collective bargaining, triplicate forms—brought its own unfairnesses. Gigging reflects the endlessly personalizable values of our own era, but its social effects, untried by time, remain uncertain.

Support for the new work model has come together swiftly, though, in surprising quarters. On the second day of the most recent Democratic National Convention, in July, members of a four-person panel suggested that gigging life was not only sustainable but the embodiment of today’s progressive values. “It’s all about democratizing capitalism,” Chris Lehane, a strategist in the Clinton Administration and now Airbnb’s head of global policy and public affairs, said during the proceedings, in Philadelphia. David Plouffe, who had managed Barack Obama’s 2008 campaign before he joined Uber, explained, “Politically, you’re seeing a large contingent of the Obama coalition demanding the sharing economy.” Instead of being pawns in the games of industry, the panelists thought, working Americans could thrive by hiring out skills as they wanted, and putting money in the pockets of peers who had done the same. The power to control one’s working life would return, grassroots style, to the people.

The basis for such confidence was largely demographic. Though statistics about gigging work are few, and general at best, a Pew study last year found that seventy-two per cent of American adults had used one of eleven sharing or on-demand services, and that a third of people under forty-five had used four or more. “To ‘speak millennial,’ you ought to be talking about the sharing economy, because it is core and central to their economic future,” Lehane declared, and many of his political kin have agreed. No other commercial field has lately drawn as deeply from the Democratic brain trust. Yet what does democratized capitalism actually promise a politically unsettled generation? Who are its beneficiaries? At a moment when the nation’s electoral future seems tied to the fate of its jobs, much more than next month’s paycheck depends on the answers.

One Thursday evening in February, Caitlin Connors texted me and said to meet her at a bar in Williamsburg called Donna. The place was large and crowded; I found her in the middle of a big group, in a corner bathed in light the color of Darjeeling. Connors is small and outgoing, with a brown Jackie O. bob that looks windswept even indoors. She had come to New York five years earlier, from Colorado, “to learn about the Internet,” she said, and she worked in marketing awhile. Agency life had not been her thing—“a lot of crazy bitches”—so she started her own branding firm, the Fox Theory, which does marketing for entrepreneurs, artists, authors, and a sleight-of-hand magician. She led me to the bar to sit. She wore a black floral blouse and skinny navy pants. “I think we’re just coming into the next wave of human civilization,” she told me, and drained her cocktail with a straw. “Humans can operate on a person-to-person basis, sharing ideas and sharing business without intermediaries.”

When Connors first came to New York, she lived with several roommates in a huge, run-down place in Chelsea she dubbed the Fox Den. When her sister came to stay with her, they moved to a newer building, the Fox Den 2.0, and that was where she discovered Airbnb. She started to rent out an extra room, and the income made them “less pinched.” When she moved again, with another roommate (she has had thirty-six roommates in total), they searched for an optimally Airbnb-able place. They ended up in Williamsburg, a neighborhood that seemed “trendy” to tourists. The Fox Den 3.0, as the new digs were christened, was a three-bedroom duplex by the Bedford Avenue subway station. It had sleek new appliances and a lovely yard; through an ingenious configuration of beds and couches, it could sleep up to twelve people.

Connors tried to rent it out one week a month. Some swapping was often required. If she and her roommate were in town during a rental, they decamped to make room for the guests. Sometimes they used an acquaintance’s pad in Manhattan, also on Airbnb. Sometimes Connors stayed at the home of an old friend. “It’s the time we have to hang out and chill and catch up,” she said. “He loves it. I love it.” The financial upsides were considerable. By Airbnb-ing out their apartment one week a month, Connors and her roommate could clear their four-thousand-dollar rent. Sometimes they were gone for longer. One golden month, Airbnb-ing brought in five figures. “That’s more than most people, smart people, make in their job,” Connors observed.

For Connors, though, the real benefit of Airbnb was that it allowed her to travel, which she still loves to do. She spent part of November in Mexico, and part of December in Jordan. She saw the Fox Den as a tool for living a worldly life without committing to a worldly career. (“Otherwise, you’d have to be another level of rich to make this work.”) She spent all of January in Cuba, which gave her a new business concept.

“In Cuba—random little town—half the town wanted me to start their Airbnb accounts for them,” she said. Connors found a population that desperately needed help with the marketing of personal brands. Now she got out her iPhone and started swiping rapidly through photos, many of which centered on azure shorelines and shirtless men. “Cuba is preserved like a time capsule,” she said. She stopped at a street scene. “Everyone drives old cars.” She swiped. “These are their farms. They plow their fields with oxen.” On her next trip, she planned to help Cuban artists market themselves as American millennials do: “I want to help the Cubans learn to make money off of their art.”

A friend of hers, Prescott Perez-Fox, passed by us, on his way out. Connors snagged him. “I don’t know what you do anymore!” she said.

Perez-Fox fished some business cards from his pocket. “I’m a graphic designer and brand strategist, and I also run a podcast, and a podcast meet-up. You should come to our meet-up,” he said, handing her a card. The card said, “NEW YORK CITY PODCAST MEETUP.” “That’s the group,” he said. “My show is on the back side.” The back of the card said, “THE BUSY CREATOR PODCAST.” “It’s about workflow and creative productivity and culture and habits for creative pros.”

“Why have I not been”—Connors blinked hard—“learning from you more often?”

“Girl, get after it!” Perez-Fox exclaimed. In addition to hosting his own podcast, he had been a guest on nine other podcasts, including “Freelance Transformation” and “Life in the Woods: Hope for Independent Creatives.” “I’m finishing a project tomorrow,” he told her. “Then I’ll be more free.”

Connors said that she was in New York at least through next week, probably, and then she was going back to Cuba. “Want to come down?” she asked.

“Ah,” Perez-Fox said. “A little bit hasty.”

One of the best things about Cuba, Connors explained when Perez-Fox had darted out into the night, was that she greeted each day there without anxiety. “Not waking up stressed every day, doing something super-rewarding, and having time to write and make art and all that stuff—that’s what I want,” she told me. Soon after we went our separate ways, she left town, to fly south.

In 1970, Charles A. Reich, a law professor who’d experienced a countercultural conversion after hanging with young people out West, published “The Greening of America,” a cotton-candy cone that wound together wispy revelations from the sixties. Casting an eye across modern history, he traced a turn from a world view that he called Consciousness I (the outlook of local farmers, self-directed workers, and small-business people, reaching a crisis in the exploitations of the Gilded Age) to what he called Consciousness II (the outlook of a society of systems, hierarchies, corporations, and gray flannel suits). He thought that Consciousness II was giving way to Consciousness III, the outlook of a rising generation whose virtues included direct action, community power, and self-definition. “For most Americans, work is mindless, exhausting, boring, servile, and hateful, something to be endured while ‘life’ is confined to ‘time off,’ ” Reich wrote. “Consciousness III people simply do not imagine a career along the old vertical lines.” His accessible theory of the baffling sixties carried the imprimatur of William Shawn’s New Yorker, which published an excerpt of the book that stretched over nearly seventy pages. “The Greening of America” spent months on the Times best-seller list.

Exponents of the futuristic tech economy frequently adopt this fifty-year-old perspective. Like Reich, they eschew the hedgehog grind of the forty-hour week; they seek a freer way to work. This productivity-minded spirit of defiance holds appeal for many children of the Consciousness III generation: the so-called millennials.

“People are now, more than ever before, aware of the careers that they’re not pursuing,” says Kathryn Minshew, the C.E.O. of the Muse, a job-search and career-advice site, and a co-author of “The New Rules of Work.” Minshew co-founded the Muse in her mid-twenties, after working at the consulting firm McKinsey and yearning for a job that felt more distinctive. She didn’t know what that was, and her peers seemed similarly stuck. Jennifer Fonstad, a venture capitalist whose firm, Aspect Ventures, backed Minshew’s company, told me that “the future of work” is now a promising investment field.

Many dreamy young people, like Caitlin Connors, see unrealized opportunity wherever they go. Some, in their careers, end up as what might be called hedgers. These are programmers also known as d.j.s, sculptors who excel as corporate consultants; they are Instagram-backed fashion mavens, with a TV pilot on the middle burner. They are doing it for the money, and the love, and, like the overladen students they probably once were, because they are accustomed to a counterpoint of self. The hedged career is a kind of gigging career—custom-assembled, financially diffuse, defiant of organizational constraint—and its modishness is why part-time Lyft driving or weekend TaskRabbit-ing has found easy cultural acceptance. But hedging is a luxury, available to those who have too many appealing options in life. It gestures toward the awkward question of whom, in the long run, the revolution-minded spirit of the nineteen-sixties really let off the leash.

As Caitlin Connors’s apartment became more popular, she faced unforeseen challenges. Cleaning had to be done rapidly, in between stays. Questions from guests required prompt responses, even when she was abroad, and had no Internet access. When Airbnb logistics started to approach “a full-time job,” she hired a management company, called Happy Host, to handle bookings, cleanings, and related chores. Happy Host normally charges twenty-five per cent of earnings, but Connors found the cost worthwhile. “I’m, like, They do everything for you?” she said. “Sign me the fuck up!”

One day, I went to visit Happy Host’s founder, Blake Hinckley, at his loft apartment on Broadway, a block from the Strand bookstore. The elevator opened into the living room, which was sparsely but stylishly furnished with caramel-colored leather couches and bright, extroverted art work. Hinckley, who is twenty-nine, had a blond cascade of hair, round glasses, and a short, raffish beard. He had studied English and economics at Middlebury College, and worked for the Boston Consulting Group, doing efficiency assessments for big companies. While travelling three hundred days a year, he was also renting an apartment, in Boston. He did the math and found that, if he’d put the place on Airbnb, he could have made tens of thousands of dollars. Around that time, consulting in New York, he met his girlfriend. “The idea of being staffed in Cleveland and doing another ‘delayering’—B.C.G.’s polite euphemism for layoffs—just seemed catastrophic,” he said. Love, freedom, and a dream of fleeing corporate America won out.

Hinckley and three roommates have Airbnb-ed their apartment (“Glam Greenwich Village 4BR Loft”). As part of its service, Happy Host arranges professional photography, and the loft, a former hat factory with Eamesian kitchen stools and a fig tree by the window, stood ready for an appraising gaze. In addition to taking photos, Happy Host writes text for Airbnb listings, screens reservation requests, coördinates check-ins, greets guests, answers e-mails, and supplies soaps, towels, and wine. Hinckley’s people remain on call for emergencies, which can arise under improbable conditions. The company once had a client who, in the space-saving fashion of New Yorkers, used the drawer under her oven as a storage area for documents and mail. She nearly lost the kitchen to a fire when a Bavarian guest attempted to bake.

The afternoon was waning, and the “unrivaled natural light” in the apartment’s “West facing windows” had turned tawny. Twin arrays of seven large, gonglike bells, each mounted on a facing wall, shot off a pong. “The gamelatron!” Hinckley explained. “My roommate was at sea, and saw a gamelatron, and had a religious experience.”

Hinckley told me that creative, affluent professionals are the company’s typical customers. “Startup founders, consultants, people in private equity have been really drawn to this, because they’re so busy, they don’t have time to respond to a guest inquiry within the hour, or the inclination to wake up at one in the morning because the guest has had a couple of cocktails and is having trouble opening the door,” he said. “Also, intellectually, the concept of pricing really resonates.” If a property is constantly booked, its prices are too low; frequent fallow periods mean the rate is high. Long stays are favored, because cleaning and coördinating make turnovers costly. Happy Host sets future rates using a proprietary algorithm.

When deciding whether to work with a host, Hinckley assesses the apartment’s appearance (enlisting a designer if necessary), amenities, and location. Opening a laptop, he asked for my Zip Code and entered it into AirDNA, a third-party subscription database that gathers Airbnb market information nationwide.

“Forty-seven rentals in your neighborhood,” he said, peering at the laptop screen. “Seventy-one per cent are occupied at any time. Your median person is making 31K there on a 22.8K two-bedroom cost.” He frowned: weak margin. “The neighborhoods we like are the ones that are really high on this trend line.” He clicked to a new data set. “SoHo, Greenwich Village. There, you have people making over fifty-five thousand dollars on their apartment, if it’s a full-time rental.” He looked at me and opened up his eyes wide. “Which is wild.”

In promotional material, Airbnb refers to itself as “an economic lifeline for the middle class.”A company-sponsored analysis released in December overlaid maps of Airbnb listings and traditional hotels on maps of neighborhoods where a majority of residents were ethnic minorities. In seven cities, including New York, the percentage of Airbnb listings that fall in minority neighborhoods exceeds the percentage of hotel rooms that do. (Another study, of user photos in seventy-two majority-black neighborhoods, suggested that most Airbnb hosts there were white, complicating the picture.) Seniors were found to earn, on average, nearly six thousand dollars a year from Airbnb listings. “Ultimately, what we’re doing is driving wealth down to the people,” Chris Lehane, the strategist at Airbnb, says.

It is, of course, driving wealth down unevenly. A study conducted by the New York attorney general in 2014 found that nearly half of all money made by Airbnb hosts in the state was coming from three Manhattan neighborhoods: the Village-SoHo corridor, the Lower East Side, and Chelsea. It is undeniably good to be earning fifty-five hundred dollars a year by Airbnb-ing your home in deep Queens—so good, it may not bother you to learn that your banker cousin earns ten times that from his swank West Village pad, or that he hires Happy Host to make his lucrative Airbnb property even more lucrative. But now imagine that the guy who lives two doors down from you gets ideas. His finances aren’t as tight as yours, and he decides to reinvest part of his Airbnb income in new furniture and a greeting service. His ratings go up. Perhaps he nudges up his prices in response, or maybe he keeps them low, to get a high volume of patronage. Now your listing is no longer competitive in your neighborhood. How long before the market leaves you behind?

I put a version of this question to Lehane on the phone one morning. In the White House, he was known as a “master of disaster” for his strategic crisis management. As Al Gore’s press secretary, in 2000, he led the double-black-diamond effort of making the Vice-President seem loose and easygoing on the campaign trail. He told me that even an arms race to the top of the market would benefit overlooked neighborhoods. “It has a ripple effect on the local economy,” he explained.

A competitive Airbnb host who hires a cleaner and a decorator in Queens creates work for locals. Guests—some of whom, Lehane insisted, prefer to be in remote neighborhoods—might patronize businesses in the area. “What we do represents a different model of capitalism,” he told me. After hanging up, he sent a six-hundred-word e-mail of elaboration, and another after that.

He pointed out that, traditionally, affluent people have accrued further wealth passively—from real estate, investments, inheritances, and the like. Those with less charmed lives have had to resort to work in exchange for money. Airbnb makes passive earning available to anyone with a spare room.

In a competitive market, though, advantaged people still end up leveraging their advantages: that is why Happy Host exists. Today, every major Airbnb city (among them London, Paris, Los Angeles, San Francisco, Chicago, and New Orleans) has multiple Happy Host equivalents to help meet rising market expectations. A two-year-old New York competitor, MetroButler, has twenty-two contractors and two cleaners, and last year bought the clientele of another competitor, Proprly. MetroButler’s co-founder Brandon McKenzie had been using Airbnb to pay down law-school debts when he realized that short-term rentals could support an entire service industry. “We’re sort of in the business of pickaxes during the Gold Rush,” he said.

Others harbor similar ambitions. “Our goal is to become a mega-behemoth,” said Amiad Soto, who, with his twin brother, co-founded Guesty, a Tel Aviv-based company that helps hosts manage bookings (or arranges for a remote operator to do so under their names). Guesty has seventy-five employees, and Soto spends much of his time hiring more. For physical work, most such companies rely on other apps—Handy, Postmates—or hire part-time workers themselves. Sharing is not only challenging an existing model; it is generating its own labor force.

One drizzly spring afternoon, I met a MetroButler worker named Bobby Allan while he prepared an apartment for guests. Allan is a conservatory-trained actor and singer in his mid-twenties. He came to MetroButler last summer, from a gig at Proprly; he also works as a cater-waiter and as a hype man at children’s parties. At MetroButler, he is a part-time contractor, without benefits, but he doesn’t mind: gig work makes it possible to take time off for more exciting endeavors (for instance, an appearance in Syfy’s “The Internet Ruined My Life”). MetroButler pays him fifty dollars for each two-hour cleaning—sixty if he greets the guests, too. “You meet so many crazy people,” he told me. The place he was cleaning, a small garden apartment with a child’s room at the back, was a regular for him. He had put fresh company linens on the queen-size bed, and had left hotel-size shampoo and conditioner bottles, with the MetroButler logo, on the nightstand. He discovered that the bulb in the desk lamp had burned out, so he made a note to buy a replacement.

In the child’s room, Allan dressed the twin bed in crisp white sheets, pulled the duvet cover over the duvet with impressive speed, and rolled a bath towel and a hand towel into little logs, to be arranged in the center of the bed. His first tax return as an independent worker had been a shock, he said. But the work had been instructive in many other ways, too. He consulted his phone. Every task was annotated on a photo of the space in an app that let MetroButler watch his progress in real time; he checked off each detail and took a photo of the room when he was done. He hummed the finale to “The Firebird” while he swept the floor.

Normally, every efficiency has a winner and a loser. A service like Uber benefits the rider, who’s saving on the taxi fare she might otherwise pay, but makes drivers’ earnings less stable. Airbnb has made travel more affordable for people who wince at the bill of a decent hotel, yet it also means that tourism spending doesn’t make its way directly to the usual armies of full-time employees: housekeepers, bellhops, cooks.

To advocates such as Lehane, that labor-market swap is good. Instead of scrubbing bathrooms at the Hilton, you can earn directly, how and when you want. Such thinking, though, presumes that gigging people and the old working and service classes are the same, and this does not appear to be the case. A few years ago, Juliet B. Schor, a sociology professor at Boston College, interviewed forty-three mostly young people who were earning money from Airbnb, Turo (like Airbnb for car rentals), and TaskRabbit. She found that they were disproportionately white-collar and highly educated, like Seth F. A second, expanded study showed that those who relied on gigging to make a living were less satisfied than those who had other jobs and benefits and gigged for pocket money: another sign that the system was not helping those who most needed the work.

Instead of simply driving wealth down, it seemed, the gigging model was helping divert traditional service-worker earnings into more privileged pockets—causing what Schor calls a “crowding out” of people dependent on such work. That distillation-coil effect, drawing wealth slowly upward, is largely invisible. On the ground, the atmosphere grows so steamy with transaction that it often seems to rain much needed cash.

“Airbnb enabled me to go back to school and become a full-time student and work as a part-time photographer.”

“Airbnb is necessary while my cousin is out of town to work.”

“I am here as an individual, not representing some radical, self-serving organization. I am speaking to my own experience.”

The streets near New York’s City Hall were ear-stinging and windy on the morning of a big Airbnb hearing, but attendees clogged the doorway, and the air inside was thick with sour human concern. A new law had made it illegal for many New Yorkers to advertise short-term rentals. The law ostensibly targeted unregulated hoteliers, who snatch up multiple apartments and Airbnb them year-round, but it served the broader interests of major hotel trade groups, such as the American Hotel and Lodging Association and the Hotel and Motel Trades Council, which lobbied against Airbnb. At the hearing, hosts protested the rule’s breadth: why not limit each member’s listings, rather than banning them all?

Christian Klossner, the executive director of the Mayor’s Office of Special Enforcement, sat behind a desk microphone, wearing a patient expression as speakers gave testimony. Suzette Sundae, a musician wearing a fifties-style swing dress and a white cardigan over her tattoos, said that she ran a vintage-clothing store in Park Slope. When the store’s traffic fell off, she had Airbnb-ed her home. “It saved me from having to declare bankruptcy, and it allowed me to close my store without owing a dime,” she said. An East New York resident named Heather-Sky McField recalled having to travel to Baltimore each week to care for her mother, who had breast cancer. She had been unable to evict her tenants, who’d stopped paying rent. “Had it not been for Airbnb, I would have been foreclosed by now,” she told Klossner.

Given such testimony, it was easy to see how the sharing economy became a liberal beacon—and easy to see the attendant paradoxes. A century ago, liberalism was a systems-building philosophy. Its revelation was that society, left alone, tended toward entropy and extremes, not because people were inherently awful but because they thought locally. You wanted a decent life for your family and the families that you knew. You did not—could not—make every personal choice with an eye to the fates of people in some unknown factory. But, even if individuals couldn’t deal with the big picture, early-twentieth-century liberals saw, a larger entity such as government could. This way of thinking brought us the New Deal and “Ask not what your country can do for you.” Its ultimate rejection brought us customized life paths, heroic entrepreneurship, and maybe even Instagram performance. We are now back to the politics of the particular.

For gigging companies, that shift means a constant struggle against a legacy of systemic control, with legal squabbles like the one in New York. Regulation is government’s usual tool for blunting adverse consequences, but most sharing platforms gain their competitive edge by skirting its requirements. Uber and Lyft avoid taxi rules that fix rates and cap the supply on the road. Handy saves on overtime and benefits by categorizing workers as contractors. Some gigging advocates suggest that this less regulated environment is fair, because traditional industry gets advantages elsewhere. (President Trump, it has been pointed out, could not have built his company without hundreds of millions of dollars in tax subsidies.)

Still, since their inception, and increasingly during the past year, gigging companies have become the targets of a journalistic genre that used to be called muckraking: admirable and assiduous investigative work that digs up hypocrisies, deceptions, and malpractices in an effort to cast doubt on a broader project. Some companies, such as Uber, seem to invite this kind of attention with layered wrongdoing and years of secrecy. But they also invite it by their high-minded positioning. Like traditional companies, gigging companies maintain regiments of highly paid lawyers and lobbyists. What sets them apart is a second lobbying effort, turned toward the public.

“We’re borrowing very heavily from traditional community-organizing models, and looking at the grass roots in each city,” Emily Castor, Lyft’s leader in the campaign against regulatory constraint, told me a while back, when we spoke in the company’s San Francisco headquarters. “Who are the leaders? Who are people who distinguish themselves as passionate, who want to get more involved? We have a team that includes field organizers who are responsible for different parts of the country.”

If Uber has come to be known as the Wicked Witch of the West, dark-logoed, ubiquitous, and dragging a flaming broom of opportunism, Lyft has sought to be the Glinda, upbeat, pink, and conciliatory, and its organizing outreach has been key to this reputation. Castor’s work was not accosting government but assembling users, building a network of ordinary people who wanted Lyft in their lives.

“They’ll have dinners and other opportunities for people to learn more about what policy activities are happening in their area,” she said. This often means turning out for community-style lobbying—like the hosts at the Airbnb hearing in New York. “We get to know who has a powerful voice that would be helpful if shared with elected officials,” she explained.

Castor is a friendly woman with tidy blond hair who also started out in Democratic politics. After college, she worked in Washington as a legislative aide for the California representative Susan Davis. In 2008, before returning to school to get a degree in public administration, she worked on an unsuccessful congressional campaign. She moved to San Francisco, and in 2011 worked as a municipal finance consultant. It was an exciting time to be in the Bay Area. In the wake of economic collapse, young people with big ideas and an understanding of mobile technology were thinking about how work could be made cheaper, lighter, and more accessible. Castor started renting out her car on Getaround, an early sharing-economy company, and then tried Zimride, Airbnb—any service she could get her hands on. Their premise of sharing moved her. “It was like falling in love,” she told me. “You ask yourself, Is this love? Is this love? And, when you find the thing that’s right, you don’t have to ask.” Early in 2012, she started an event series, Collaborative Chats, devoted to the sharing economy. When Lyft launched, in June, 2012, the founders hired her to be the company’s first “community manager.” She found that she could draw on her political training. “Collective identity is one of those aspects that, in the theory of social movements, is so important,” she told me. “You’re not just ‘taking rides.’ ”

A key architect of that organizing strategy is Marshall Ganz. From the sixties through the early eighties, he worked under Cesar Chavez, leading the organizing efforts of the United Farm Workers. Now, at the Harvard Kennedy School, he teaches what he calls “a story of self, a story of us, a story of now”: the collective-identity movement-building method that Castor invoked. In July, 2007, he led a boot camp to train Obama’s first battalion of organizers for Iowa and South Carolina’s primary contests. He told me that he found the sharing companies’ use of grassroots methods “problematic.”

“There’s a difference between exchange, which is what markets are all about, and discernment of common purpose, which is what politics is about,” he said. Ganz told me that he had been distraught after Obama’s victory in 2008 when the Democratic National Committee seemed to abandon the President’s grassroots network. What he had hoped would be a movement had been cast aside as an electoral tool that had served its purpose.

Castor, who is nearly four decades younger than Ganz, had a different heroic ideal for social change. “When I worked on the Hill,” she recalled, “my chief of staff used to say, ‘A political campaign is a startup that is designed to go out of business.’ ”

Questions have emerged lately about the future of institutional liberalism. A Washington Post /ABC News poll last month found that two-thirds of Americans believe the Democratic Party is “out of touch,” more than think the same of the Republican Party or the current President. The gig economy has helped show how a shared political methodology—and a shared language of virtue—can stand in for a unified program; contemporary liberalism sometimes seems a backpack of tools distributed among people who, beyond their current stance of opposition, lack an agreed-upon blueprint. Unsurprisingly, the commonweal projects that used to be the pride of progressivism are unravelling. Leaders have quietly let them go. At one point, I asked Chris Lehane why he had thrown his support behind the sharing model instead of working on traditional policy solutions. He told me that, during the recession, he had suffered a crisis of faith. “The social safety net wasn’t providing the support that it had been,” he said. “I do think we’re in a time period when liberal democracy is sick.”

In “The Great Risk Shift: The New Economic Insecurity and the Decline of the American Dream” (2006), Jacob Hacker, a political-science professor at Yale, described a decades-long off-loading of risk from insurance-type structures—governments, corporations—to individuals. Economic insecurity has risen in the course of the past generation, even as American wealth climbed. Hacker attributed this shift to what he called “the personal-responsibility crusade,” which grew out of a post-sixties fixation on moral hazard: the idea that you do riskier things if you’re insulated from the consequences. The conservative version of the crusade is a commonplace: the poor should try harder next time. But, although Hacker doesn’t note it explicitly, there’s a liberal version, too, having to do with doffing corporate structures, eschewing inhibiting social norms, and refusing a career in plastics. Reich called it Consciousness III.

The slow passage from love beads to Lyft through the performative assertion of self may be the least claimed legacy of the baby-boomer revolution—certainly, it’s the least celebrated. Yet the place we find ourselves today is not unique. In “Drift and Mastery,” a young Walter Lippmann, one of the founders of modern progressivism, described the strange circumstances of public discussion in 1914, a similar time. “The little business men cried: We’re the natural men, so let us alone,” he wrote. “And the public cried: We’re the most natural of all, so please do stop interfering with us. Muckraking gave an utterance to the small business men and to the larger public, who dominated reform politics. What did they do? They tried by all the machinery and power they could muster to restore a business world in which each man could again be left to his own will—a world that needed no coöperative intelligence.” Coming off a period of liberalization and free enterprise, Lippmann’s America struggled with growing inequality, a frantic news cycle, a rising awareness of structural injustice, and a cacophonous global society—in other words, with an intensifying sense of fragmentation. His idea, the big idea of progressivism, was that national self-government was a coöperative project of putting the pieces together. “The battle for us, in short, does not lie against crusted prejudice,” he wrote, “but against the chaos of a new freedom.”

Revolution or disruption is easy. Spreading long-term social benefit is hard. If one accepts Lehane’s premise that the safety net is tattered and that gigging platforms are necessary to keep people in cash, the model’s social erosions have to be curbed. How can the gig economy be made sustainable at last?

During the final days of the Obama Administration, I went to see Tom Perez, at that time the Secretary of Labor and now—after a candidacy fraught with inner-party conflict—the chair of the Democratic National Committee. Perez, tieless in a white shirt, greeted me from a couch. Beyond the stresses of leaving the Cabinet, he had just experienced a bad nosebleed and looked drained.

“If you’re looking for the five-point blueprint, I don’t have it,” he said, when I asked about his vision for the gigging labor market. Last year, he pushed the Census Bureau to reinstate the Contingent Worker Supplement to gather data. (The government currently has no information on a gigging sphere as such.) He believed that any long-term labor model should include input from workers, but wasn’t sure what that should look like. “Voice can take a lot of forms,” Perez said. “I’m a big fan of collective bargaining and the labor movement, but I recognize that there are other ways.”

Perez champions what he calls “conscious capitalism”—free-market liberalism, with an eye to workers’ rights—and he insisted to me that profit-seeking and benefits-giving are not at odds. “Shareholders are best served when all stakeholders are well served!” he explained. The mind-set was mainstream during the nineteen-nineties, and still runs strong in the tech community, with its doing-well-by-doing-good ethos. One popular idea is that app markets regulate themselves with online ratings by and of everyone involved in a transaction.

The record here is mixed. Some earners complain about the way rating systems favor the judgment of customers (Seth F. told me that it is hard to challenge a poor rating) and can be leveraged for haggling purposes. (Some Airbnb customers, Blake Hinckley, of Happy Host, said, use trivial problems to seek a refund.) And reputation governance can’t pick up patterns of unjust exclusion. Research on Airbnb found that identical profiles given different ethnic names were treated differently by hosts, and that pricing on equivalent apartments ran lower for black hosts than for everybody else. (A couple of weeks ago, Airbnb agreed to let a regulatory body, in California, test for discrimination; the company itself has instituted an aggressive program to try to curb such behavior.) Still, you cannot regulate somebody’s house or car the way you regulate a hotel or a taxi.

“Someone who’s hosting on Airbnb might say, ‘Well, this is my space. I only want a certain kind of guest in my spare bedroom,’ ” Arun Sundararajan, an N.Y.U. business professor, says. Is that unreasonably discriminatory? In a new book, “The Sharing Economy,” he proposes a halfway measure like Airbnb’s: self-regulation in collaboration with government. Many elected politicians like a long-leash approach, too. In November, 2014, after an Uber employee described tracking a journalist’s movements, Senator Al Franken sent a list of privacy-policy queries to Uber’s C.E.O.; last fall, Franken pressed Uber and Lyft about apparent race-based discrepancies in wait times. “What I’m trying to do is help customers understand what these companies are doing, and encourage these companies to put in place voluntary measures,” Franken told me soon after dispatching the first letter. Some companies have taken preëmptive measures. Laura Copeland, the head of community at Lyft, describes having created an “advisory council” of seven drivers to make sure that the people on the street have a voice in the company.

Other assessments suggest that employees, too, should get their houses in order. “To succeed in the Gig Economy, we need to create a financially flexible life of lower fixed costs, higher savings, and much less debt,” Diane Mulcahy, a senior analyst at the Kauffman Foundation and a lecturer at Babson College, writes in her book “The Gig Economy,” which is part economic argument and part how-to guide. Ideally, gig workers should plan not to retire. (Beyond Airbnb hosting, Mulcahy sees prospects for aging millennials in app-based dog-sitting.) If they must retire, they should prepare. Mulcahy suggests bingeing on benefits when they come. Fill your dance card with doctors while you’re on employee insurance. Go wild with 401(k) matching—it will come in handy.

This ketchup-packet-hoarding approach sounds sensible, given the current lack of systemic support. Yet, as Mulcahy acknowledges, it’s a survival mechanism, not a solution. Turning to deeper reform, she argues for eliminating the current distinction between employees (people who receive a W-2 tax form and benefits such as insurance and sick days) and contract workers (who get a 1099-MISC and no benefits). It’s a “kink” in the labor market, she says, and it invites abuse by efficiency-seeking companies.

Calls for structural change have grown loud lately, in part because the problem goes far beyond gigging apps. The precariat is everywhere. Companies such as Nissan have begun manning factories with temps; even the U.S. Postal Service has turned to them. Academic jobs are increasingly filled with relatively cheap, short-term teaching appointments. Historically, there is usually an uptick in 1099 work during tough economic times, and then W-2s resurge as jobs are added in recovery. But W-2 jobs did not resurge as usual during our recovery from the last recession; instead, the growth has happened in the 1099 column. That shift raises problems because the United States’ benefits structure has traditionally been attached to the corporation rather than to the state: the expectation was that every employed person would have a W-2 job.

“We should design the labor-market regulations around a more flexible model,” Jacob Hacker told me. He favors some form of worker participation, and, like Mulcahy, advocates creating a single category of employment. “I think if you work for someone else, you’re an employee,” he said. “Employees get certain protections. Benefits must be separate from work.”

In a much cited article in Democracy, from 2015, Nick Hanauer, a venture capitalist, and David Rolf, a union president, proposed that workplace benefits be prorated (someone who works a twenty-hour week gets half of the full-time benefits) and portable (insurance or unused vacation days would carry from one job to the next, because employers would pay into a worker’s lifelong benefits account). Other people regard the gig economy as a case for universal basic income: a plan to give every citizen a modest flat annuity from the government, as a replacement for all current welfare and unemployment programs. Alternatively, there’s the proposal made by the economists Seth D. Harris and Alan B. Krueger: the creation of an “independent worker” status that awards some of the structural benefits of W-2 employment (including collective bargaining, discrimination protection, tax withholding, insurance pools) but not others (overtime and the minimum wage).

I put these possibilities to Tom Perez. He told me that he didn’t like the idea of eliminating work categories, or of adding a new one, as Harris and Krueger suggest: you’d lose many of the hard-won benefits included with W-2 employment, he said, either in the compromise to a single category or because current W-2 companies would find ways to slide into the new classification. He wanted to move slowly, to take time. “The heart and soul of the twentieth-century social compact that emerged after the Great Depression was forty years in the making,” he said. “How do we build the twenty-first-century social compact?”

Perez’s new perch, at the D.N.C., has given him a broader platform, and a couple of hours after the House passed the American Health Care Act last week, he championed the old safety net in forceful language. “Scapegoating worker protections is often a lazy cop-out for some who want to change the rules to benefit themselves at the expense of working people,” he told me. “We shouldn’t have to choose between innovation and the most basic employee protections; it’s a false dichotomy.” The entanglement of the sharing economy and Democratic politics has continued—Perez’s press secretary at the Department of Labor now works for Airbnb—but his approach had circumspection. “Any changes you make to policies or regulations have to be very careful and take all potential ripple effects into account and keep the best interest of the worker in mind.”

His own effort to do that led him one day to New York, where he stopped by a company called Hello Alfred. “I just wanted to introduce us a little bit, explaining why we’re here,” Marcela Sapone, the company’s C.E.O. and co-founder, said. “I think the best way to do that is to show you what we do. I heard that you like Coke heavy”—that is, the opposite of Coca-Cola light—“so we went ahead . . . ” She handed him a miniature bottle.

“The perfect size!” Perez exclaimed. He looked delighted and confused.

“At Alfred,” Sapone went on, “we think that help should be built into your life.” Sapone and her co-founder, Jess Beck, had met at Harvard Business School after leaving McKinsey. “We were thinking about how we were going to balance a career, building a family, building a social life in the community—you’d have to be a superhero. So we asked for some help to become that superhero,” Sapone said.

Unlike TaskRabbit, Hello Alfred is based on recurring service. When customers download the app and sign up, they’re assigned a single tasker, called a home manager, who comes once or twice a week, on a schedule. Alfred taskers often have keys and let themselves in; the idea is that, like traditional home help, they get to know their clients’ preferences and quirks. “It’s sort of a weird relationship you build with this person,” Leah Silver, a client who is an elementary-school teacher on the Upper West Side, told me. “They know so much about you.”

The reason for Perez’s visit was an unusual feature of Hello Alfred’s model: although the taskers can work part time, on a schedule they determine, all are full W-2 employees. Perez considered the company to be a model—creative, well-intentioned, and kind toward its employees—and praised it between pulls on his Coke heavy. “I appreciate that you’re understanding the high road is the smart road,” he said. “This is not an act of charity! This is an act of enlightened self-interest.”

He would have been more correct to call it self-interest tamed. Sapone told me later that it’s expensive to carry a staff of W-2 workers on a gigging schedule. The tax burden is greater for Hello Alfred than it would be on a 1099 model, the hourly rate is high, and the required human-resources infrastructure drives up the cost. Attrition is low, but W-2 companies are also vulnerable to various employee lawsuits from which 1099 employers are insulated.

For now, however, companies such as Hello Alfred, going above and beyond market demands out of principle, may be the gig economy’s best hope. And, occasionally, the principles travel. Blake Hinckley has already moved the most senior three of his six Happy Host staff cleaners onto W-2 status. The reason, he told me, is Sapone: they knew each other in Boston, and she convinced him that any honorable company owed its workers employment benefits.

One afternoon, I accompanied a Hello Alfred tasker named Phillip Pineno as he went to service apartments in Kips Bay. A placid guy with tiny silver hoops in his ears and a hipster’s dusky beard, Pineno does tasking four days a week and, like Bobby Allan, works in his remaining time as an actor. In the lobby of a building facing Bellevue South Park, he gathered packages and ascended to a client’s apartment—one of eleven he’d visit that day. A bag of Trader Joe’s Veggie & Flaxseed Tortilla Chips went in a cupboard. A box of cereal was tucked into position on the counter. Pineno used to be a caterer, doing events at Lincoln Center and the Museum of Natural History. The work was fine, he said, but unpredictable, different from Hello Alfred. “You get to feel more like a human,” he told me. He could take time every week to work toward his dream without gambling his future on it. He had found some sense of workplace comfort—of being valued and known.

For many gig workers, as for Seth F., that dream remains elusive. When Seth F. had finished hanging art work in my living room, I led him to the dining room. He took a small electric drill and some screws out of his backpack, and started driving them into the plaster. We were hanging a small print of a Sol LeWitt drawing, squares in squares in squares. He extracted a laser level, and projected it across the wall. “This is my favorite tool,” he told me, with a moving tenderness. He rarely met other taskers, he said; there were no colleagues in his life with whom he could share experiences and struggles. The flexibility was great, if you had something to be flexible for.

“The gig economy is such a lonely economy,” he told me. He left his drill behind after he finished the work, but I was out when he returned the next day to get it. I never saw him again. ♦

Harvard Business School’s Annual Contest for Entrepreneurs is a Case Study Unto Itself

A dozen early-stage startups on Tuesday will make their case for why they should receive $75,000 and, perhaps more importantly, a whole lot of attention from the venture capital world.

Those are the rewards of the annual Harvard Business School New Venture Competition, which this year celebrates its 20th anniversary. To mark the anniversary, the Globe looked back at some notable participants in the competition.

(Read on Boston Globe)

One early winner’s business grew fast after the competition, but was humbled by the dot-com bust. A more recent victor’s potentially important product hasn’t gotten out of the development stage.

Those who fell short of the top prize are also illustrative of the contest’s history, including its founder, who went on to work in venture capital, and a company that was ridiculed by the contest’s judges but has since raised more than $150 million.

This year’s finalists include companies making bug spray that can last for days, wearable devices for women meant to guard against sexual assault, accessories to make football helmets safer, and an app that lets anybody with a car ship packages.

Throughout the school year, the judges, who include Harvard faculty, venture capitalists, and entrepreneurs, have whittled nearly 300 entrants to just 12. The contest ends Tuesday night, producing three winners — one each from sub-categories added over the past two decades.

The most straightforward category is open to any proposed business that includes at least one active HBS student as a founder. There’s also a category for alumni that requires competitors to have at least one HBS graduate on their executive team. Finally, companies in the “social enterprise” competition must focus on solving a major social issue. The winners, as decided by the judges, will each get $75,000, up from $50,000 last year.

Past winners and finalists have focused on fertility issues, ride-hailing in Asia and South America, and using Internet-connected devices to improve 911 emergency services. Some have grown to become well-funded companies, while others no longer exist.

Harvard wasn’t the first school with this kind of contest; the Massachusetts Institute of Technology’s pitching competition, for example, is closing in on 30 years of history. Nor is the contest the only one at Harvard, which since 2011 has held the President’s Innovation Challenge for the entire student body.

But each year, the HBS competition provides a fairly public look at some of the ideas bubbling up at one of the top business schools. And the two-decade mark offers a chance to look back at some of the companies that have been born out of it.

A dubious distinction

A few years back, Michael Schrader was excited when his company, Vaxess Technologies, became the first-ever two-time winner of the competition, collecting the business track award in 2012, followed by the alumni award in 2013.

It turned out to be a dubious distinction.

“Someone said to us, ‘Do you know why you were the only one to win twice?’ ” said Schrader, Vaxess’s chief executive. “We were the only ones who failed to raise venture capital funding within the first 12 months of winning.”